|

Mandatory Documents: For Cargo Clearance - Clearing Agents(Extract from page 5 in SOP document)All goods to be imported into the Country shall be labeled in ENGLISH in addition to any other language of transaction; otherwise the goods shall be confiscated. All Imports into the Country shall be accompanied by the following documents:

|

Obtaining a Tax Identification Number (TIN) From Federal Inland Revenue Service (FIRS) - For Cargo Clearance - Clearing Agents(Extract from page 6 in SOP document)Required Company Documents

|

Obtaining Relevant Certificates and Permits: For Cargo Clearance - Clearing Agents |

Electronic Form ‘M’(Extract from page 7 in SOP document) |

|

The e-Form ‘M’ and the relevant pro-forma invoice (which shall have a validity period of three months) shall carry a proper description of goods to be imported to facilitate price verification viz;

e-Form ‘M’ is obtained from your Authorized Dealer Bank and completed with the help of the Authorized Dealer Bank. Upon completion, e-form M is transmitted by the authorizing bank to the Nigeria Customs Service for verification and registration. Consequently, Authorized Dealer Banks are to confirm registration of the e-Form ‘M’ before proceeding with other import processes. e-Form ‘M’ processing consists of the following:

|

Importation(Extract from page 7 in SOP document) |

|

Electronic Manifest(Extract from pages 7 and 8 in SOP document)On procedure to gain access for transmission and integration of manifest on Nigeria Integrated Customs Integrated System (NICIS) See https://www.customs.gov.ng/Guidelines/eManifest

|

Electronic Pre-Arrival Assessment Report (PAAR)(Extract from page 8 in SOP document)

Documents to be transmitted not later than 6 hours from time of receipt by the Authorized Dealer Bank. |

Electronic Single Goods Declaration (SGD)(Extract from page 9 in SOP document)

|

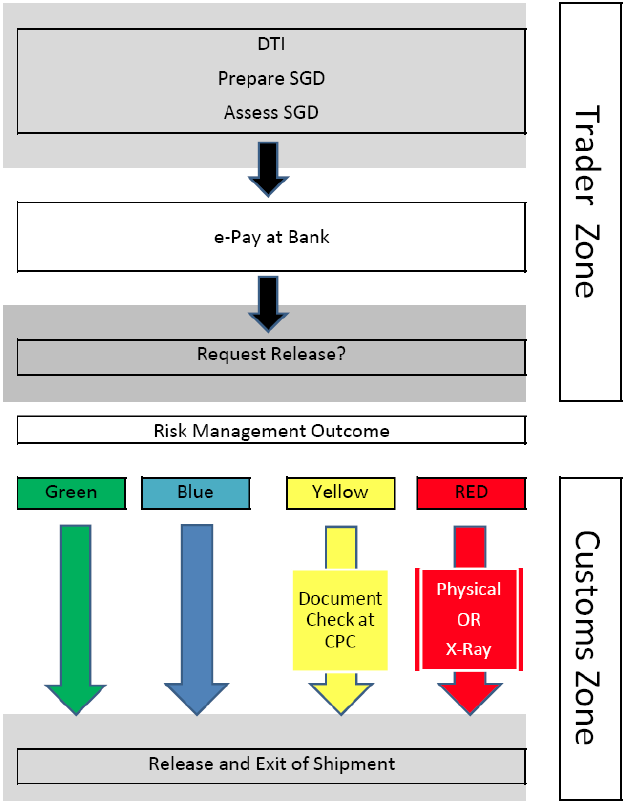

NCS Risk Management System will indicate immediately the selectivity lane.(Extract from page 12 in SOP document)

|

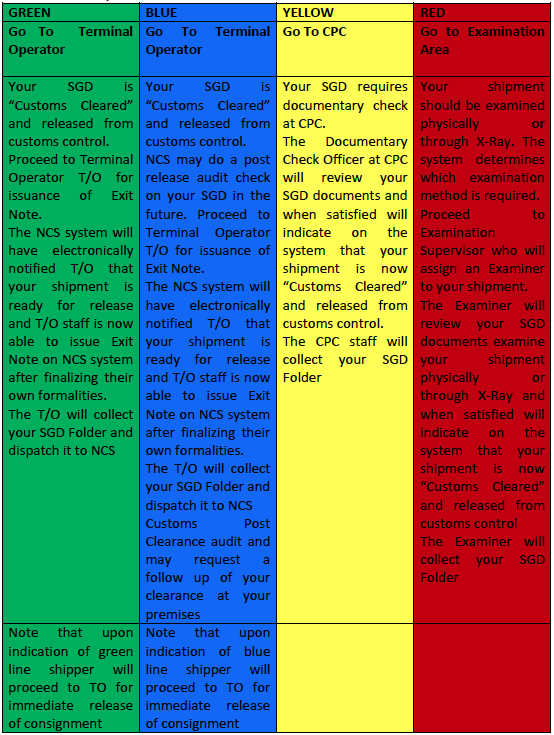

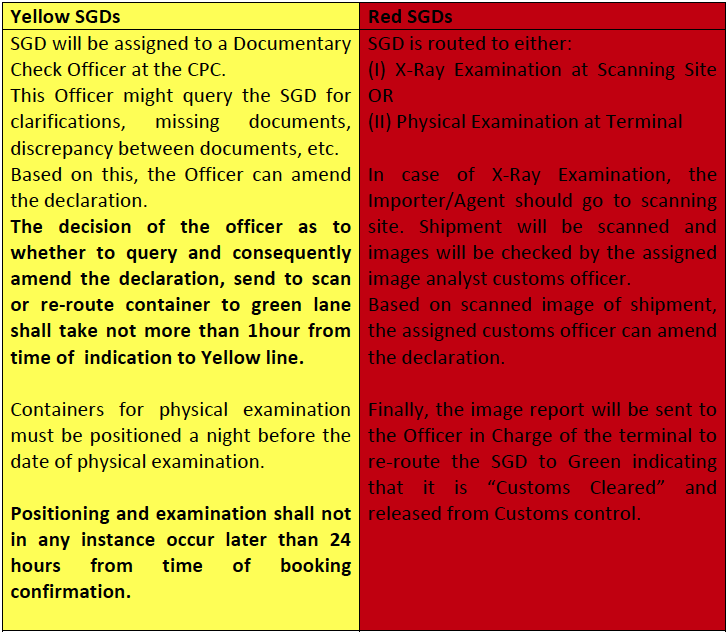

Proceed as described below:(Extract from page 13 in SOP document)

|

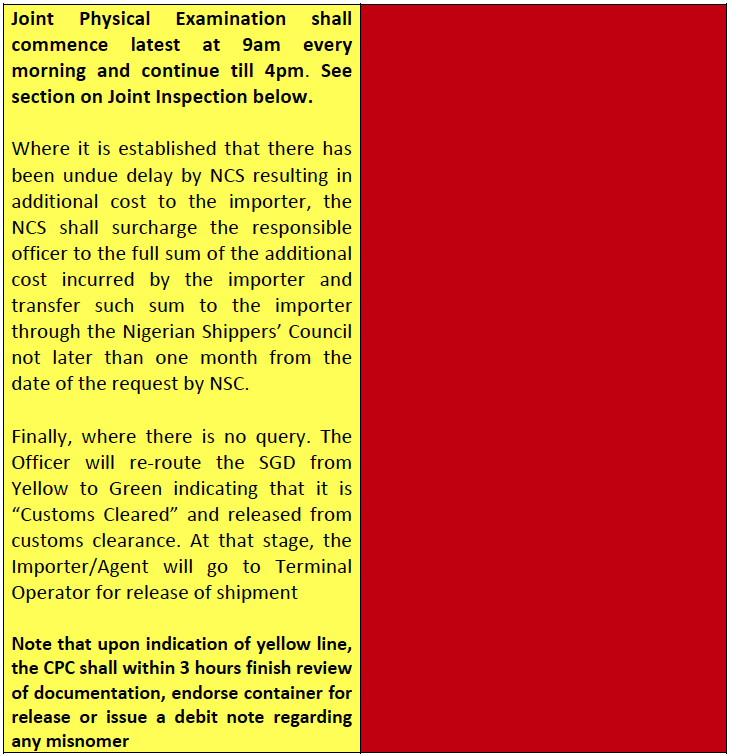

Procedure for Joint Examination of Cargo: Cargo Clearance - For Clearing Agents and NCS officers(Extract from pages 14 and 15 in SOP document)Representative of Authorized Agencies shall report to the examination Bay not later than 8:30am every morning. Joint Physical Examination shall commence latest at 9am every morning and continue till 4pm. Every Authorized Agency shall designate sufficient officers to simultaneously cover all examination groups at each examination bay, and failure to do so shall in no instance be allowed to lead to delay of examination and release of cargo. Failure of any Agency representative other than that of the Nigeria Customs Service to attend the Joint Examination shall not delay the examination and such an Agency shall lose the right to examine that container. |

Electronic EXIT of SGDs from NCS Authorized Terminals: Cargo Clearance - For Clearing Agents(Extract from page 15 in SOP document)

At the gate, the Customs officer will acknowledge exit on the NCS system and a confirmation will be received that the consignment has been released and has exited the Port. |

Important Without Destination Inspection (DI): Cargo Clearance - For Clearing Agents and NCS officers(Extract from page 15 in SOP document)Where an Importer is exempted from DI according to Import Guideline. Step 1: Importer applies in writing to NCS valuation office at the designated port attaching the Bill of Lading/ Bill of Sight Step 2: Importer request the Terminal Operator to position container for scanning and physical examination. (see procedure and time for examination of container above) Step 3: NCS issues assessment not later than 3 hours after examination. Step 4: Importer pays according to valuation. Step 5: NCS issues Customs Release Note not later than 1 hour from time of payment. |

Gate Control: Cargo Clearance - For Clearing Agents and NCS officers(Extract from page 16 in SOP document)

|

Search After Exit Note Release: Cargo Clearance - For Clearing Agents and NCS officers(Extract from page 16 in SOP document)NCS will no longer stop and search any consignments that have been officially released whether at the Common User Gate or anywhere else outside the premises of Port or Land Borders from where the consignment has been released. Any other Agency including the NCS which for any reason desires to search the officially released consignment must accompany it to the final destination. |

Delay Resulting From Documentary/Physical Examination Query - For Shipping company and Ship agent(Extract from page 17 in SOP document)

|

Goods In Transit: Cargo Clearance - For Clearing Agents and NCS officers(Extract from page 18 in SOP document)Goods on transit through Nigerian Ports and Corridors to neighboring countries are not subject to Import/Excise duty. Transport documents for such goods must specify Port/Country of Destination. Provision for escort and escort fee, etc would be in line with Regional, Sub-Regional and Bi-lateral Agreements. |

Procedure for Export: Cargo Clearance - For Clearing Agents and NCS officers(Extract from page 18 in SOP document)Pre-conditions:

|

Export Shipment: Cargo Clearance - For Clearing Agents and NCS officers(Extract from page 21 in SOP document)Duration: 3 - 5 Days

|

Export Cargo Declaration: Cargo Clearance - For Clearing Agents and NCS officers(Extract from page 21 in SOP document)Duration: 1 Day

|

Export Post-Shipment Documentation: Cargo Clearance - For Clearing Agents and NCS officers(Extract from page 21 in SOP document)Duration: 3 Days

|

| Download Complete SOP here |

|